As a digital or performance marketer, understanding the value of your customers is essential for making informed decisions about your marketing and sales strategies. One important metric that can help you measure this value is Customer Lifetime Value or LTV.

In this blog, we’ll explain what LTV is, why it’s important, how to calculate it, and how to use it to improve your marketing efforts.

Table of Contents

What is Customer Lifetime Value (LTV)?

Customer Lifetime Value, or LTV, is the total value a customer brings to a business over the course of their entire relationship. It’s a way to measure the long-term profitability of your customer base, and it takes into account not just the revenue generated by a single purchase, but also the likelihood that a customer will make additional purchases in the future.

In other words, LTV tells you how much money you can expect to earn from a customer over the course of their lifetime as a customer of your business.

There are several factors that contribute to LTV, including:

- The average purchase value: This is the average amount of money a customer spends each time they make a purchase from your business.

- The purchase frequency: This is how often a customer makes a purchase from your business in a given period of time.

- The customer lifespan: This is how long a customer remains a customer of your business.

By understanding these factors and calculating your LTV, you can make informed decisions about how much money to invest in acquiring new customers, and how much to invest in retaining your existing customers.

Why is LTV important for Digital or Performance marketers?

LTV is an important metric for digital or performance marketers for several reasons. Here are just a few:

- It helps you understand the profitability of your customer base: By calculating your LTV, you can get an idea of how much money each customer is worth to your business over time. This can help you make informed decisions about how much money to invest in new customer acquisition, and how much to invest in retaining your existing customers.

- It helps you identify areas for improvement: If your LTV is lower than you’d like it to be, it can be a sign that you need to focus on improving your customer retention efforts (you need to bring them back to do repeat purchases), or that you need to adjust your pricing or product offerings to encourage more repeat purchases.

- It helps you calculate your ROI: By comparing your LTV to your Customer Acquisition Cost (CAC), you can calculate your return on investment (ROI) for your marketing efforts. This can help you make informed decisions about where to allocate your marketing budget for maximum impact.

How to calculate Customer Lifetime Value or LTV

Calculating LTV (Customer Lifetime Value) requires a bit of data crunching, but don’t worry, it’s not too complicated.

Here’s a step-by-step guide:

- Calculate your average purchase value (or Average Order Value – AOV): This is the average amount of money a customer spends each time they make a purchase from your business. To calculate this, simply divide your total revenue by the total number of purchases made by your customers.

- Calculate your purchase frequency: This is how often a customer makes a purchase from your business in a given period of time. To calculate this, divide the total number of purchases by the total number of unique customers.

Let’s say you got 100,000 sales in a year. And the total (unique) number of customers that purchased from you is 25000.

That means on average, each customer purchased 4 times from you. That’s the frequency. - Calculate your customer lifespan: This is the measure of how long a customer remains a customer of your business. To calculate this, you’ll need to choose a time frame (such as 1 year) and determine the percentage of customers who remain active customers for that entire time frame.

For example, if 80% of your customers remain active customers for one year, your customer lifespan would be one year divided by 0.8, or 1.25 years. - Calculate your Customer Lifetime Value: To calculate your LTV, simply multiply your average purchase value by your purchase frequency and then multiply that by your customer lifespan. The formula for calculating LTV is:

LTV = Average Purchase Value x Purchase Frequency x Customer Lifespan

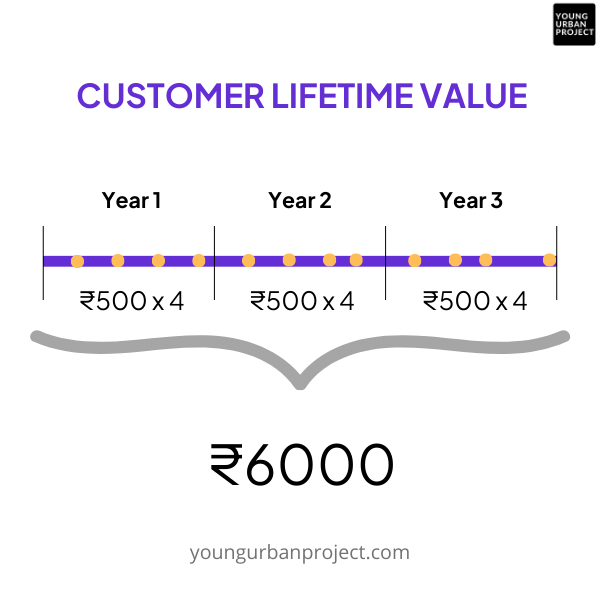

For example, if your average purchase value is ₹500, your purchase frequency is 4 purchases per year, and your customer lifespan is 3 years, your LTV would be:

LTV = ₹500 x 4 x 3 = ₹6000

So each customer, on average, is worth ₹6000 to your business over the course of their entire relationship with you.

Learn Performance Marketing from Top Industry experts in 10 Weeks:

If you are looking to become a high-paid performance marketer that can bring profitable results with paid advertising and data analytics, our 10-week program can be a game-changer for you. Learn from experts who work with companies like Google, Microsoft, Linkedin, Swiggy and more.

What does LTV say about a company’s health?

LTV is a valuable metric for assessing the long-term health of a business. Generally speaking, a high LTV shows that a company has a strong & loyal customer base that is likely to generate significant revenue over time.

Conversely, a low LTV (Customer Lifetime Value) can be a sign that a company needs to focus on improving its customer retention efforts or adjusting its pricing or product offerings to encourage more repeat purchases.

In addition, comparing LTV to CAC (Customer Acquisition Cost) can provide valuable insights into the health of a company’s marketing efforts.

If LTV is significantly higher than CAC, it indicates that the company is generating more revenue from its customers than it is spending to acquire those customers. This is a good sign, as it suggests that the company is generating a positive return on investment from its marketing efforts.

CheckOut: Advanced Performance Marketing Bootcamp

How to improve Customer Lifetime Value

There are several strategies that digital marketers can use to improve LTV. Here are a few:

- Focus on customer retention: The longer a customer remains a customer of your business, the more value they will bring over time. By focusing on customer retention efforts such as personalized marketing, loyalty programs, and excellent customer service, you can encourage customers to remain loyal to your brand and make more purchases over time.

- Upsell and cross-sell: Encouraging customers to purchase additional products or services can increase their overall LTV. By recommending related products or services and offering exclusive discounts to loyal customers, you can encourage customers to make additional purchases and increase their LTV.

- Improve your customer experience: Customers are more likely to remain loyal to a brand that provides an excellent customer experience. By focusing on improving your website, checkout process, and customer service, you can create a more positive experience for your customers and increase their likelihood of making repeat purchases.

Conclusion

Customer Lifetime Value (LTV) is a powerful and useful metric for digital & performance marketers that can help you measure the long-term profitability of your customer base. By understanding your LTV, you can make informed decisions about how much money to invest in acquiring new customers, how much to invest in retaining your existing customers, and where to allocate your marketing budget for maximum impact.

Calculating LTV requires a bit of data crunching, but it’s a valuable exercise that can help you assess the health of your business and identify areas for improvement. By focusing on customer retention, upselling and cross-selling, and improving your customer experience, you can increase your LTV and generate more revenue from your existing customer base.

If you liked this blog post and would like to see more valuable content on your social feeds, Follow us on Instagram.