Lifetime value (LTV) is a critical metric in performance marketing that helps businesses understand the long-term value of their customers. Calculating LTV accurately allows marketers to make informed decisions about customer acquisition and retention strategies, optimize marketing budgets, and ultimately drive profitability.

In this Blog, we will walk you through the process of calculating LTV step-by-step, with real-world examples to make the concept clearer.

Table of Contents

What is Lifetime Value (LTV)?

Lifetime Value (LTV) is a key metric in performance marketing that measures the total revenue a business can expect from a single customer account throughout their relationship.

LTV helps businesses understand the long-term value of their customers and informs decisions on marketing strategies, customer acquisition costs, and retention efforts.

By calculating LTV, companies can determine how much to invest in acquiring and retaining customers to maximize profitability. This metric also provides insights into customer behavior, allowing businesses to identify and target their most valuable customer segments, optimize marketing campaigns, and develop strategies to enhance customer loyalty and engagement.

Overall, LTV is essential for creating sustainable growth and ensuring long-term success.

Why is LTV Important in Performance Marketing?

- Budget Allocation: Knowing the LTV helps in allocating marketing budgets more effectively by focusing on channels and strategies that attract high-value customers.

- Customer Retention: By understanding the value of existing customers, businesses can develop strategies to improve retention rates and increase customer lifetime value.

- Profitability: LTV provides insights into the long-term profitability of different customer segments, allowing businesses to focus on the most lucrative ones.

Step-by-Step Guide to Calculate LTV

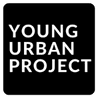

Step 1: Determine Average Purchase Value

To calculate the Average Purchase Value, divide the total revenue generated by the number of purchases made during a specific period. This metric helps you understand how much, on average, a customer spends per purchase. The formula is:

This value provides insight into customer spending behavior, enabling you to tailor your marketing strategies to maximize revenue per transaction.

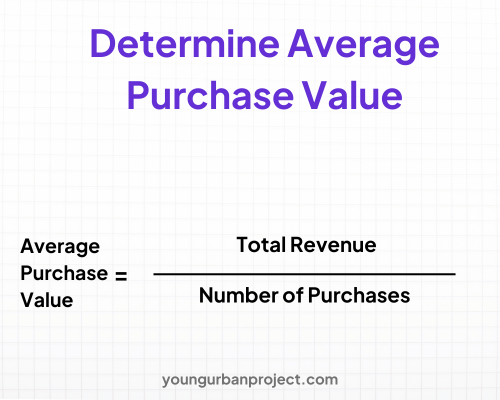

Step 2: Calculate the Average Purchase Frequency Rate

To calculate the Average Purchase Frequency Rate, divide the total number of purchases by the number of unique customers within a specific period. This metric indicates how often, on average, a customer makes a purchase. The formula is:

Understanding this frequency helps assess customer loyalty and purchase behavior, providing valuable insights for developing targeted marketing strategies to increase the purchase rate.

Ckeckout: Best Performance Marketing Course

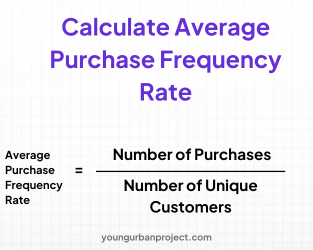

Step 3: Determine Customer Value

To determine Customer Value, multiply the Average Purchase Value by the Average Purchase Frequency Rate. This metric represents the total revenue generated by a customer over a specific period. The formula is:

This value is crucial for understanding the revenue potential of each customer, allowing you to identify and focus on the most valuable customer segments to maximize overall business profitability.

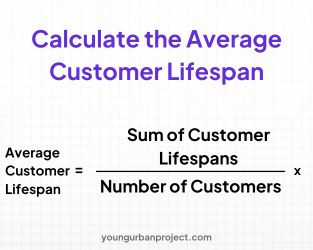

Step 4: Calculate the Average Customer Lifespan

To calculate the Average Customer Lifespan, determine the average length of time (usually in years) that a customer continues to purchase from your business. This can be estimated based on historical data and customer behavior patterns.

This metric helps predict long-term revenue from a customer and is essential for understanding the overall value and longevity of your customer relationships.

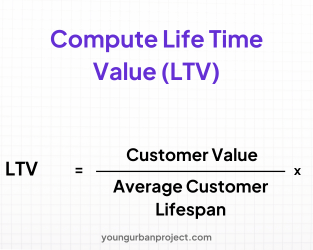

Step 5: Compute Lifetime Value (LTV)

To compute Lifetime Value (LTV), multiply the Customer Value by the Average Customer Lifespan. This metric provides the total revenue a business can expect from a customer over their entire relationship.

This calculation is essential for understanding the long-term profitability of customers and for making informed decisions about marketing investments and customer retention strategies.

Key Metrics to Monitor

To ensure the accuracy of your LTV calculation, regularly monitor and update the following metrics:

- Customer Acquisition Cost (CAC): The cost incurred to acquire a new customer.

- Churn Rate: The rate at which customers stop doing business with you.

- Gross Margin: The difference between revenue and the cost of goods sold.

Optimizing LTV in Performance Marketing

Optimizing Lifetime Value (LTV) is crucial for maximizing the long-term profitability of your customer base. By focusing on increasing the value each customer brings over their lifetime, you can drive sustained business growth and improve your marketing ROI. Here are some strategies to optimize LTV in performance marketing:

1. Improve Customer Retention

Customer retention is a key driver of LTV. The longer customers stay with your business, the more they contribute to your revenue. To improve retention, consider the following tactics:

- Loyalty Programs: Implement loyalty programs that reward repeat purchases and long-term engagement.

- Personalized Marketing: Use customer data to deliver personalized experiences and targeted offers.

- Customer Service Excellence: Provide exceptional customer service to enhance satisfaction and reduce churn.

- Regular Communication: Keep in touch with customers through email newsletters, special promotions, and updates.

2. Increase Average Order Value (AOV)

Increasing the average amount customers spend per purchase can significantly boost LTV. Strategies to achieve this include:

- Upselling and Cross-Selling: Recommend higher-value products or complementary items during the purchase process.

- Bundling Products: Offer product bundles at a discounted price to encourage customers to buy more.

- Limited-Time Offers: Create urgency with limited-time discounts or special deals.

3. Enhance Customer Experience

A positive customer experience leads to higher satisfaction, loyalty, and repeat business. Focus on the following areas to enhance the customer experience:

- User-Friendly Website: Ensure your website is easy to navigate, fast, and mobile-friendly.

- Seamless Checkout Process: Simplify the checkout process to reduce cart abandonment.

- Personalized Interactions: Use customer data to personalize interactions and make customers feel valued.

- Post-Purchase Engagement: Follow up with customers after purchase to show appreciation and encourage future purchases.

4. Leverage Customer Feedback

Customer feedback is invaluable for understanding customer needs and improving your offerings. Implement the following practices to leverage feedback effectively:

- Surveys and Reviews: Regularly collect customer feedback through surveys and reviews.

- Act on Feedback: Use the feedback to make improvements to products, services, and customer experience.

- Show Appreciation: Thank customers for their feedback and keep them informed about changes based on their suggestions.

5. Implement a Customer Relationship Management (CRM) System

A CRM system helps manage customer relationships more effectively by providing insights into customer behavior and preferences. Benefits of a CRM system include:

- Centralized Data: Store all customer information in one place for easy access and analysis.

- Personalized Marketing: Use CRM data to create targeted marketing campaigns and personalized offers.

- Customer Segmentation: Segment customers based on behavior, preferences, and value to tailor marketing efforts.

6. Offer Value-Added Services

Adding value beyond the initial purchase can enhance customer loyalty and increase LTV. Consider offering:

- Extended Warranties: Provide extended warranties or service plans to encourage repeat business.

- Educational Content: Share valuable content, such as how-to guides, tutorials, and industry insights, to position your brand as a trusted resource.

- Exclusive Access: Give loyal customers exclusive access to new products, events, or promotions.

Also Read: Digital Marketing vs Performance Marketing – Key Differences

Conclusion

Calculating Lifetime Value (LTV) is essential for making informed marketing decisions and driving long-term profitability. By following the step-by-step guide outlined in this article, you can accurately determine your LTV and develop strategies to enhance it.

Remember to regularly update your calculations and adjust your marketing efforts accordingly to maximize the value of your customers.For those seeking to master performance marketing and leverage LTV effectively, Young Urban Project stands out as the premier platform.

With its comprehensive performance marketing course, Young Urban Project offers in-depth training and practical insights to help you excel in this dynamic field. The course is designed to equip you with the skills and knowledge needed to optimize LTV and achieve marketing success.